Uncovering Wyckoff VSA Secrets in the USD/CHF Move

The Wyckoff VSA Secrets behind this USD/CHF move have revealed critical signs of weakness and distribution, making it a high-probability short trade setup. By applying Wyckoff Volume Spread Analysis (VSA), I was able to detect Smart Money activity before the trend shifted bearish.

The Wyckoff method, championed by Richard Wyckoff and further refined by David Weis, emphasizes the role of supply, demand, volume, and price action in forecasting market movements. One of the most crucial aspects of Wyckoff VSA is recognizing when institutional players (the Composite Man) are offloading their positions while retail traders remain trapped in the wrong direction.

This article will break down:

- How volume and price action confirmed the bearish move

- How Wyckoff VSA Secrets exposed a USD/CHF distribution phase

- My trade entry is at 0.8963 and the target at 0.8400

- Multi-timeframe analysis (Daily, 4-hour, and 1-hour)

Wyckoff VSA Secrets: Identifying Smart Money in the USD/CHF Move

In the Wyckoff method, Smart Money leaves behind footprints in the form of volume, price action, and structural formations. In the case of USD/CHF, multiple signs suggested that the market was undergoing distribution before a move lower.

Key Wyckoff VSA Secrets That Signaled the USD/CHF Move:

1️⃣ Failure to Reach Resistance – The price attempted to rally multiple times but failed to touch the upper trendline, showing a lack of demand.

2️⃣ Volume Anomalies – Buying volume was decreasing during upward price movements, indicating weak hands buying while Smart Money was distributing.

3️⃣ Lower Highs & Weak Closes – The price struggled to maintain bullish momentum, printing lower highs and weak closes, confirming selling pressure.

4️⃣ Decreasing Volume on Retracements – A true bullish market should see rising volume on rallies and declining volume on pullbacks. In this case, volume contracted on rallies, signaling weak buying interest.

5️⃣ Composite Man Offloading Positions – Large institutions distribute positions slowly and subtly, avoiding panic among retail traders.

Multi-Timeframe Wyckoff VSA Analysis of USD/CHF

A proper Wyckoff VSA trade setup requires analyzing multiple timeframes to confirm market direction. Here’s how the Daily, 4-hour, and 1-hour charts provided a complete picture of Smart Money’s activities in USD/CHF.

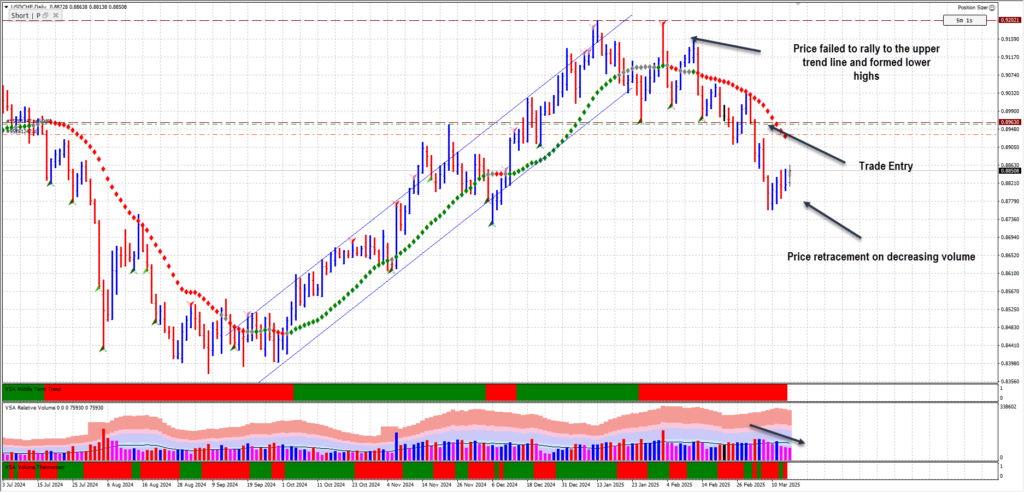

USD/CHF Daily Chart Analysis: Long-Term Distribution Phase

The Daily chart provided the macro perspective for this trade. Before placing my short position, I observed several key distribution patterns:

📉 Uptrend Weakness – While the price had been moving higher, the rallies were lacking momentum, evidenced by shrinking volume.

📉 Failed Breakout Attempts – Each time USD/CHF approached a key resistance, it failed to sustain higher prices, indicating a lack of demand.

📉 Bearish Reversal Signs – The market produced a long upper wick on key resistance levels, showing selling pressure from Smart Money.

The daily timeframe confirmed that USD/CHF was in the late stages of distribution, with institutions preparing for a markdown phase. This gave me confidence in shorting the market.

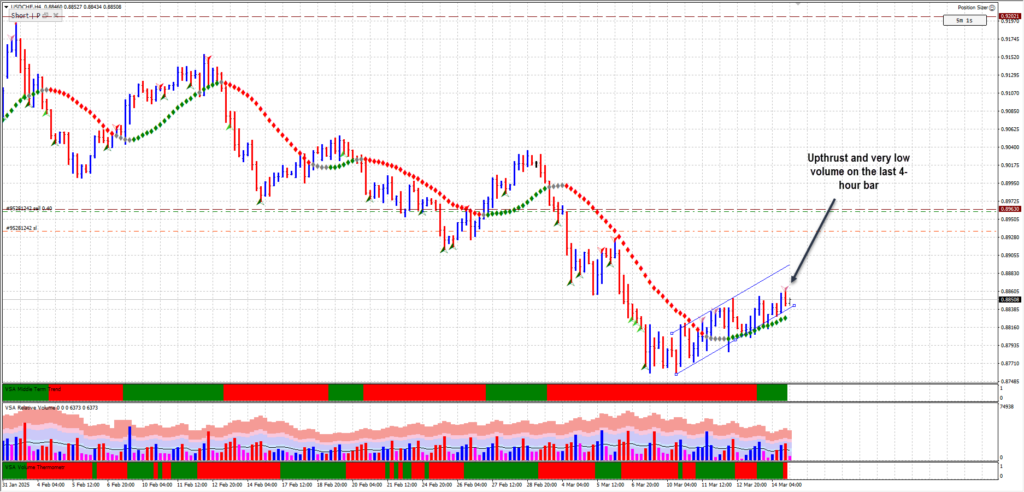

Wyckoff VSA Secrets: 4-Hour Chart Confirms Smart Money Distribution

Analyzing the Retracement & Trend Channel

Following the initial markdown, the 4-hour chart now shows a retracement, with the price consolidating within a descending trend channel. However, the key Wyckoff VSA Secrets suggest that this pullback is merely a temporary reaccumulation of supply before another markdown phase.

📉 Failure to Reach the Upper Trend Channel – Price is now struggling to reach the upper boundary of the trend channel, indicating that demand is weakening, a strong Wyckoff VSA signal of continued bearish momentum.

📉 Decreasing Volume on Retracement – The current pullback is occurring on declining volume, suggesting that buyers lack conviction. According to Wyckoff VSA principles, a true reversal requires strong volume expansion, which is absent in this move.

Trade Plan Based on Wyckoff VSA Secrets

Given these conditions, my Wyckoff VSA Secrets analysis suggests that the USD/CHF move is preparing for another breakdown. If price confirms this by failing to regain higher levels with strong volume, I will add to my short position, anticipating further downside.

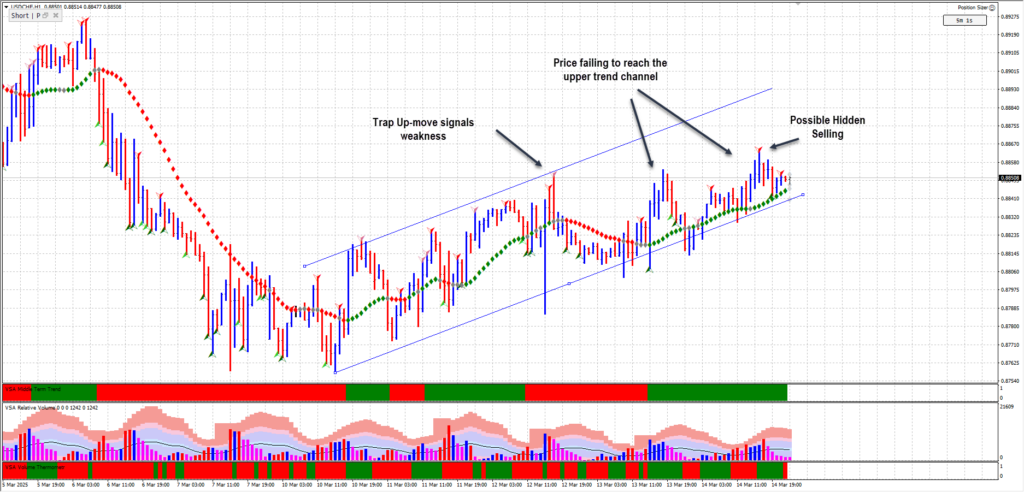

Wyckoff VSA Secrets: 1-Hour Chart Confirms Smart Money Distribution

Similar to the 4-hour chart, the 1-hour chart reveals key Wyckoff VSA signals indicating that Smart Money is distributing positions before a potential markdown phase.

Currently, price remains within an upward trend channel, yet volume behavior contradicts bullish continuation. The decreasing volume on up bars combined with higher volume on down bars suggests that supply is actively entering the market, weakening the structure of the USD/CHF move.

Additionally, classic VSA principles are emerging, including:

📉 Trap Up-Move – Price briefly spikes higher, only to reverse sharply on increased volume, a sign of Smart Money inducing buying from weak-handed traders before offloading their own positions.

📉 Hidden Selling – A subtle form of institutional distribution where price appears to rise but does so on declining volume, indicating that demand is failing to support higher prices.

📉 Failure to Reach the Upper Trend Channel – According to Wyckoff’s methodology, a healthy uptrend should see price testing and surpassing the upper boundary of a trend channel. The inability of USD/CHF to do so suggests that buying pressure is fading, reinforcing the likelihood of a bearish reversal.

1-Hour Chart Conclusion: Distribution Unfolding, Momentum Weakening

The Wyckoff VSA Secrets unfolding on the 1-hour chart confirm that Smart Money is methodically distributing their positions. The presence of trap up-moves, hidden selling, and volume imbalances all point to a weakening market structure. The failure to reach the upper trend channel signals a loss of momentum, increasing the probability of a markdown phase.

If selling pressure continues to escalate, I anticipate a breakdown below the trend channel, at which point I will consider adding to my short position in alignment with Wyckoff VSA principles.

Wyckoff VSA Secrets: The Importance of Volume in Confirming the USD/CHF Move

📊 Volume analysis is key in Wyckoff VSA. When the price rises without volume expansion, it suggests a fake rally driven by weak hands.

📊 Supply Absorption – If an asset is trending higher, but volume is decreasing, it means Smart Money is selling into strength, preparing for a reversal.

📊 Price vs. Volume Relationship – A real bull market should show expanding volume on rallies and contracting volume on retracements. In this case, volume was shrinking on up moves and increasing on down moves, a classic Wyckoff VSA bearish signal.

USD/CHF Trade Target & Risk Management

📍 Entry: 0.8963

📍 Stop-Loss: Above recent swing high

📍 Target: 0.8400

This trade followed Wyckoff markdown phase principles, targeting a previous area of strong demand where Smart Money could step in again.

Frequently Asked Questions (FAQs)

1. How do Wyckoff VSA Secrets help predict Smart Money movements?

They reveal how institutions operate through volume anomalies, price action, and market structure, allowing traders to anticipate major trend reversals.

2. Why did you short USD/CHF at 0.8963?

The Wyckoff VSA Secrets analysis showed:

✔ Distribution phase confirmation

✔ Smart Money absorption of supply

✔ Bearish price action and volume divergence

3. How does volume confirm a Wyckoff VSA trade?

🔸 Increasing volume on down moves signals selling pressure.

🔸 Decreasing volume on up moves confirms a lack of real demand.

4. What is the significance of failing to reach the upper trendline?

It signals a lack of demand, meaning buyers are running out of strength, allowing sellers to take control.

5. What is your target and risk management strategy?

My target is 0.8400, with a tight stop above recent highs, maintaining a 3:1 reward-to-risk ratio.

🚀 Final Thoughts on Wyckoff VSA Secrets & the USD/CHF Move

By applying Wyckoff VSA Secrets, I was able to identify Smart Money’s exit strategy before the USD/CHF move reversed bearish. This is why understanding Wyckoff’s principles gives traders a huge edge in the forex market.

Check out my annotated USD/CHF charts and give me your thoughts about your view of the USD/CHF? Let me know in the comments!

Leave a Reply