Introduction: Why Climatic Action Matters in Trading

Understanding market movements requires recognizing the footprints of smart money activity. The Wyckoff Method and Volume Spread Analysis (VSA) are two powerful approaches used by professional traders to detect accumulation and distribution phases. One of the most significant signals in this methodology is Potential Climactic Action. This pattern reveals how professional buyers absorb supply, leading to high-probability reversal setups.

In this article, we will explore Potential Climactic Action, analyzing its market background, key characteristics, and future price expectations, giving you the tools to trade with institutional knowledge.

What is Potential Climactic Action?

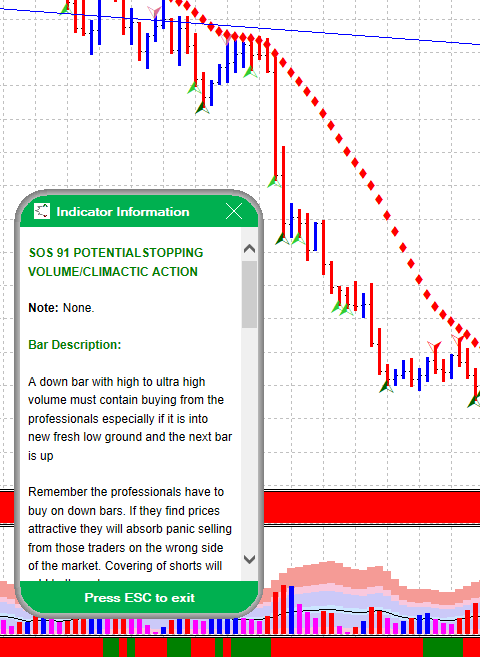

Potential Climactic Action refers to a down bar with high to ultra-high volume, often into new low ground, followed by an up bar. This indicates that one or more professional groups have identified the underlying market as good value and have stepped in to buy and absorb supply.

This is a critical VSA signal because it suggests that the downtrend may be reaching exhaustion, with smart money accumulating positions while retail traders panic and sell.

The Market Background: Recognizing a Climactic Setup

To confirm Potential Climactic Action, the market should be in a clear downtrend in the background. This means that weak holders are panicking and selling, providing professionals with an opportunity to acquire holdings at a discount.

Key Characteristics of a Climactic Action Setup:

- A strong downtrend leading into the pattern.

- Ultra-high volume on the down bar.

- The next bar should close higher, confirming buying interest.

- Signs of supply absorption by professional traders.

This phase is crucial because the professionals must buy on down bars to avoid moving prices against themselves. Covering of short positions also adds to the volume.

How to Trade Potential Climactic Action

Step 1: Identify the Climactic Action

Look for a wide-range down bar with ultra-high volume into fresh lows. This should occur after a prolonged downtrend, signaling a potential exhaustion of selling pressure.

Step 2: Confirm with the Next Bar

The next bar should close higher, confirming that professional buyers have stepped in. If the next bar is also down, the setup may require further accumulation before an upward move.

Step 3: Monitor for Accumulation & Retests

Even after the climatic signal, professionals may continue accumulating by selling small amounts to push prices back down temporarily. This tests supply levels to ensure weak holders have been removed before the next phase.

Step 4: Look for Shakeouts and Testing

Professionals will often conduct shakeouts to trap weak holders before the actual move up. A wide spread down bar closing near the highs with low volume is an ideal confirmation that supply has disappeared.

The Future Outlook After Climatic Action

Once a Potential Climactic Action signal appears, traders should expect further accumulation before a major uptrend begins. However, it is crucial to remain patient, as smart money will test for the remaining supply before committing to a sustained rally.

If the market is still weak, expect:

- High-volume up bars close off the highs, followed by a down bar.

- Upthrusts on high volume, showing continued supply.

- No demand signals, indicating insufficient buying pressure.

When professionals confirm that supply has been removed, the market will be ready for an upward move.

Why Potential Climactic Action Is Crucial for Traders

This Wyckoff and VSA pattern allows traders to align with institutional money flow rather than reacting to retail-driven emotional moves. Recognizing climatic action early can provide a powerful trading edge, offering opportunities to enter long positions before the broader market catches on.

Key Takeaways:

✅ Smart Money Buys During Panic Selling – Retail traders are selling at the worst time, while professionals are accumulating.

✅ Volume Confirms Professional Activity – High volume on a down bar with absorption signals accumulation.

✅ Confirm the Move with a Higher Close – A higher close after climatic action is a strong indication of future strength.

✅ Be Patient for the Accumulation Phase – The market may test supply levels before breaking out.

FAQs

1. What is Potential Climactic Action?

It is a Wyckoff and VSA signal indicating smart money accumulation on a high-volume down bar, followed by a higher close.

2. How do I confirm a true climactic action setup?

Look for a strong downtrend, ultra-high volume, and an up bar confirming buying interest. Weak setups will lack follow-through.

3. What happens if the next bar after climatic action is down?

This could indicate further accumulation is needed before a reversal occurs. Smart money often tests for remaining supply before making their move.

4. How can I use this pattern in my trading?

Monitor SOS*129 setups in forex, stocks, and commodities to identify potential reversals. Combine this with VSA confirmation signals for higher probability trades.

5. Can this pattern fail?

Yes, if the market is still weak, supply may overpower demand. Always wait for confirmation and manage risk accordingly.

Further Reading:

Leave a Reply