-

How to Generate Cash Flow from Stocks Using Smart Trading Strategies

Introduction: The Common Pitfalls of Stock Market Investing When it comes to investing in the stock market, most investors follow the traditional “Buy, Hope, and Pray” strategy. They purchase stocks and hope the price increases over time. However, this strategy lacks certainty and risk management, leading to significant losses during market downturns. This outdated approach…

-

Stock Market Sell-Off: Wall Street Panic and Trading Opportunities

The stock market sell-off is causing widespread panic, with Wall Street experiencing a sharp and unexpected market correction. This downturn has led to significant declines across major indexes, raising concerns about the future of the economy. As uncertainty grips the financial world, traders are seeking opportunities in volatility while long-term investors question their next moves….

-

Why Trading Success is About Expected Value, Not Accuracy

Introduction: The Trading Mindset That Wins Many traders mistakenly believe that a high win rate guarantees profitability. However, trading success isn’t about winning more trades—it’s about maximizing expected value (EV) over time. In this guide, we’ll explore why expected value is the key to long-term trading success, the importance of patience, and how journaling can…

-

NZD/USD Wyckoff & VSA Guide: Smart Money’s Next Big Move!

The NZD/USD Wyckoff & VSA Analysis reveals notable price action, leading traders to question whether the market is gearing up for an upward breakout or preparing for another leg down. Understanding these movements through Wyckoff methodology and Volume Spread Analysis (VSA) allows traders to determine if smart money is accumulating or distributing their positions. This…

-

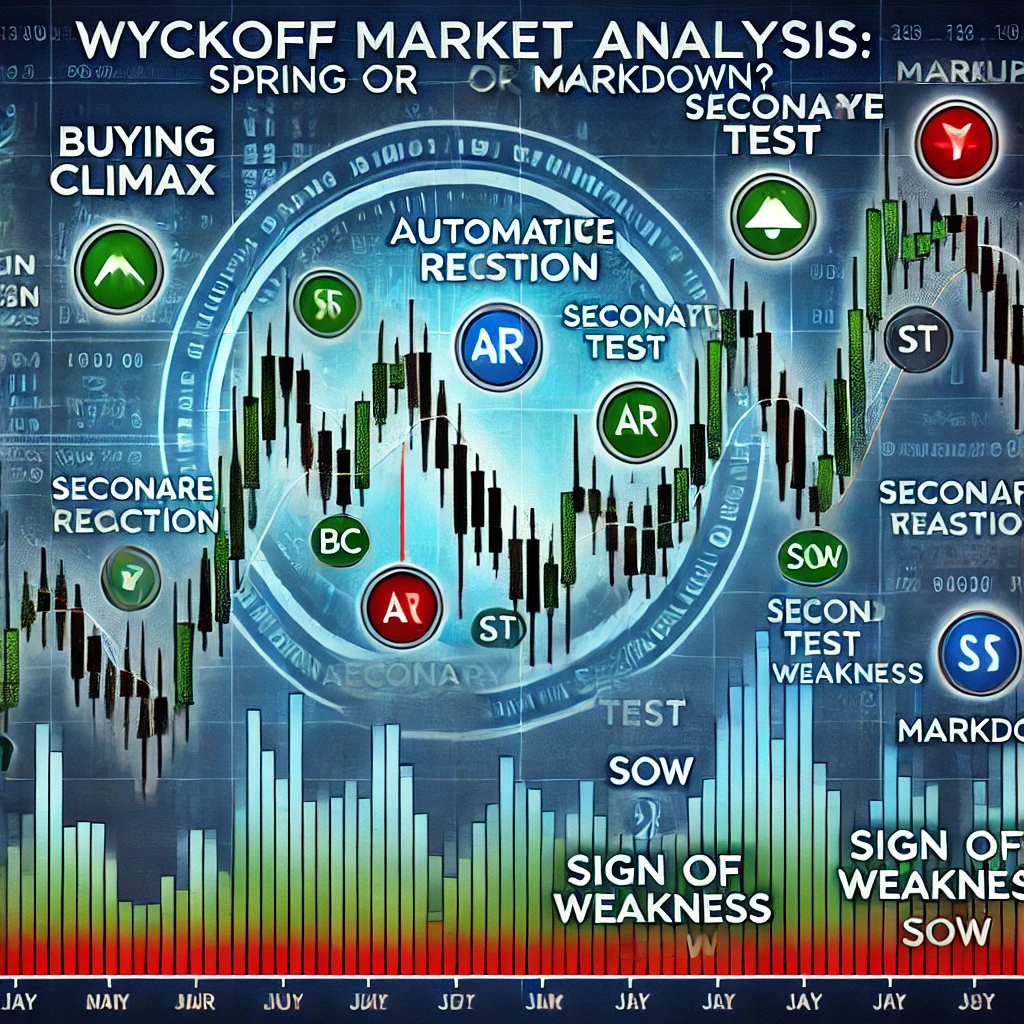

Wyckoff Analysis: Is the Market Setting Up for a Spring or Further Markdown?

The Wyckoff Method remains one of the most reliable frameworks for understanding market cycles, institutional activity, and price movements. By analyzing recent price action and volume dynamics, we can determine whether the market is positioning itself for accumulation (a bullish setup) or markdown (a bearish continuation). Analyzing the S&P 500 with the Wyckoff Method For…

-

NZD/USD Weakness Ahead? A Comprehensive Wyckoff & VSA Analysis

The NZD/USD currency pair has been showing weakness on the 1-hour chart, aligning with Wyckoff and Volume Spread Analysis (VSA) principles. A trap upmove during the recent non-farm payroll (NFP) release signaled potential weakness, followed by a no-demand bar, confirming the lack of buying interest. Meanwhile, the 4-hour chart reveals an upbar on very low…