-

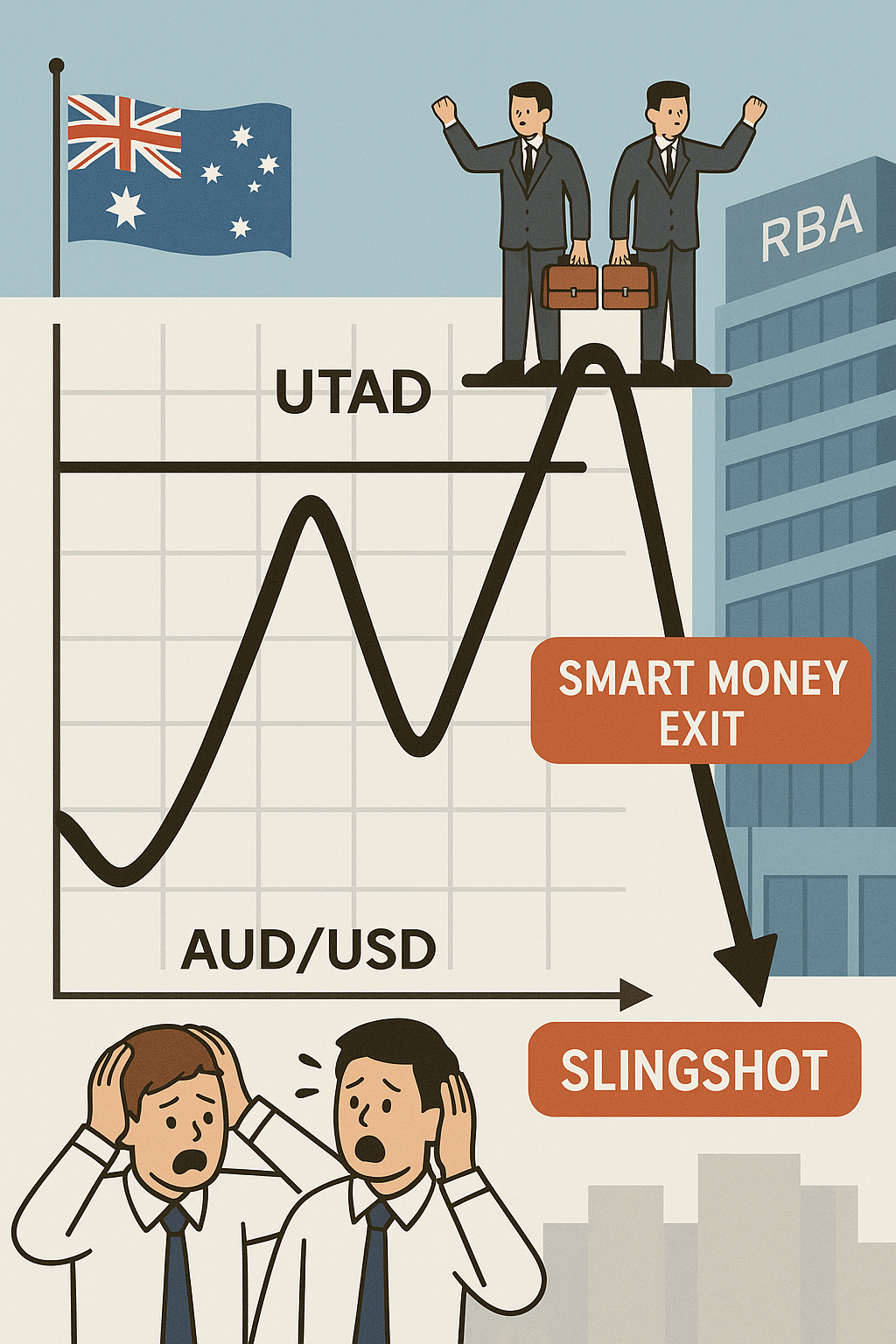

Slingshot Trade Unleashed: How Smart Money Used the RBA’s AUD Breakout to Trap the Herd

Introduction: A Classic Slingshot Trade Wrapped in a Rally The Australian dollar (AUD) surged past key resistance levels on April 29, 2025. This followed bullish commentary from RBA Assistant Governor Christopher Kent. Retail traders piled into long positions, believing that macro fundamentals justified the move. The Smart Money saw it differently — they recognised the…

-

AUDUSD Forecast Today: How I Executed a Winning Trade Using VSA and Wyckoff

AUDUSD Forecast Today: Technical Trade Analysis Near Resistance at 0.64000 In the AUDUSD forecast today, we discuss how I placed a winning trade. This was done using principles from Volume Spread Analysis (VSA) and Wyckoff methodology. The market rallied to a significant resistance level of around 0.64000. This was a key psychological barrier. This occurred…

-

Market Volatility 2025: Why This Time Is Different

Insights inspired by Jason Shapiro at CrowdedMarketReport.com What’s Really Driving Market Volatility in 2025? Market volatility 2025 is unlike anything we’ve seen before—massive swings, retail euphoria, and price action that just doesn’t make sense. This week, I listened in on Jason Shapiro’s latest market call from Crowded Market Report, and wow—he didn’t hold back. He…

-

Trading Tariffs News Like the Smart Money

Smart Money vs Retail Reactions to Major Tariff News Trading tariffs news and other major events often shake the markets. Retail traders and institutional “smart money” respond very differently. One of the most telling examples of this difference was during former U.S. President Donald Trump’s announcement of sweeping global tariffs. While many retail traders reacted…

-

Becoming a Change Agent: The Inner Spark That Sustains Personal Growth

The Emotional Spark of Change You’re all in on the emotion to become a change agent. For some of us, the status quo just isn’t enough. We catch glimpses of the person we’re meant to be—more alive, more purposeful, more fulfilled. In those quiet, mundane moments of life, something stirs. That yearning is the seed…