The Importance of Recognizing Smart Money Footprints

In forex trading, Smart Money leaves footprints in the form of price action and volume. Recognizing these patterns using Volume Spread Analysis (VSA) and Wyckoff methodology can be the difference between success and failure. One of the most effective ways to track institutional activity is by marking key support and resistance levels. This provides a roadmap for price movement, helping traders anticipate Smart Money’s intentions and avoid falling into common traps. Using Smart Money trading strategies ensures traders align with the market’s true direction rather than being misled by retail sentiment.

Smart Money Trading Strategies: Establishing Key Resistance Levels

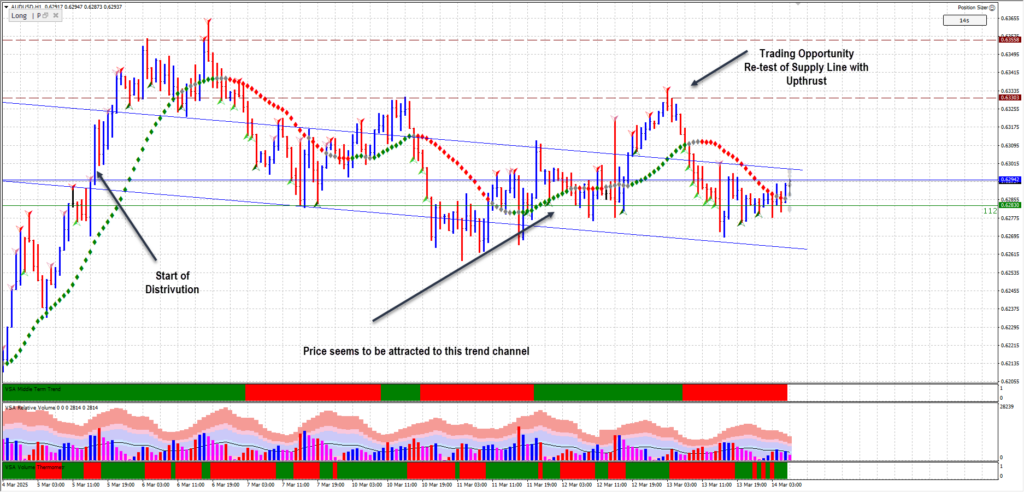

On March 5, 2025, at 21:00 UTC, the AUD/USD hourly chart formed a key resistance level at 0.63303, identified from an automatic rally that followed initial weakness. This level became critical in the unfolding price action, serving as an area where professional selling began. Smart Money often engineers price movements to create liquidity, and understanding their tactics through technical tools like VSA allows traders to align with market reality rather than react emotionally. Smart Money trading strategies emphasize the importance of identifying these resistance levels to avoid false breakouts and unnecessary losses.

Smart Money Trading Strategies: Upthrust and Supply Confirmation

As price approached 0.63303, it exhibited classic Wyckoff distribution behavior. A significant event occurred on March 6, 2025, at 03:00 UTC when the price briefly pierced resistance before reversing—an Upthrust, a key signal of professional selling. This was followed by two crucial volume events at 17:00 and 18:00 UTC, showing Supply Coming In, which confirmed the presence of selling pressure. These were not random occurrences but calculated moves by Smart Money to absorb buying interest before a markdown phase. Smart Money trading strategies help traders interpret these signals to avoid falling into liquidity traps.

Smart Money Trading Strategies: Market Breakdown and Weak Rallies

Once the market absorbed liquidity, a breakdown followed. Price fell below support, entered a trend channel, and made a weak rally back toward the supply line. This action was expected since markets do not move in straight lines but instead exhibit waves of buying and selling. The ability to recognize these phases is critical for traders using Smart Money trading strategies, as price often returns to previously established supply zones before resuming its intended direction.

Smart Money Trading Strategies: CPI News and Institutional Manipulation

March 12, 2025, introduced fundamental volatility with the release of US CPI data. The numbers showed a 2.8% y/y increase, slightly below the forecast of 2.9%. These economic events often serve as catalysts for major price swings, providing Smart Money with an opportunity to manipulate liquidity. The chart reflected this with two ultra-high volume bars: the first, a widespread down bar closing on its lows, and the second, a smaller up bar with slightly higher volume. This is a clear indication that Smart Money was still distributing, using the news event as an opportunity to transfer holdings to uninformed participants. Smart Money trading strategies account for these fundamental catalysts to determine whether a move is genuine or a trap.

Smart Money Trading Strategies: The Final Upthrust After Distribution (UTAD)

The final confirmation of weakness came with a textbook Upthrust After Distribution (UTAD). This is a final trap, where price retests supply zones one last time before a major markdown. The reaction was immediate—price collapsed back into the trend channel, confirming that professional selling had concluded, and Smart Money was no longer interested in higher prices. Traders who recognize these patterns in real time gain a significant edge, as they can position themselves accordingly rather than reacting emotionally to price fluctuations. Smart Money trading strategies emphasize recognizing the UTAD as an ideal entry for short positions.

Key Lessons from This Price Action

- Marking Key Levels is Essential: Smart Money operates around supply and demand zones. Knowing where these levels are helps traders avoid emotional trading.

- Fakeouts Serve a Purpose: Upthrusts and false breakouts are designed to lure in retail traders and absorb liquidity before reversals.

- News Events Provide Liquidity for Smart Money: Major announcements like CPI often facilitate moves that align with pre-existing technical patterns.

- VSA Validates Wyckoff Analysis: By analyzing volume alongside price action, traders can confirm whether a move is genuine or manipulated.

- Smart Money Trading Strategies Prevent Mistakes: Understanding these strategies can help traders avoid entering weak positions and align with institutional market behavior.

Conclusion

Traders who wish to improve their market understanding must move beyond simple indicators and embrace market structure, volume dynamics, and institutional behavior. The AUD/USD price action around 0.63303 perfectly exemplifies how Smart Money trading strategies influence price movement, offering valuable insights to those who study the market with precision.

Frequently Asked Questions (FAQs)

1. What is Smart Money in trading?

Smart Money refers to institutional investors, hedge funds, and market makers who influence price movements by strategically accumulating or distributing positions.

2. How does Wyckoff methodology help traders?

The Wyckoff method helps traders understand market cycles, including accumulation, distribution, markup, and markdown, allowing them to anticipate price movements based on Smart Money behavior.

3. What is an Upthrust in Volume Spread Analysis (VSA)?

An Upthrust is a price movement where an asset briefly breaks above resistance before reversing, often signaling professional selling and weakness in the market.

4. Why is the CPI report important for forex trading?

The Consumer Price Index (CPI) measures inflation and impacts currency value. Higher-than-expected CPI figures can strengthen a currency, while lower figures can weaken it.

5. How can traders use trend channels in Smart Money trading?

Trend channels help traders identify market structure, showing areas of accumulation and distribution. These channels guide traders in setting entry and exit points based on institutional activity.

Leave a Reply