Trading before major economic announcements like the Non-Farm Payroll (NFP) report is high-risk but can present profitable opportunities when executed correctly. To navigate this volatility, I relied on the Wyckoff and Volume Spread Analysis (VSA) to interpret Smart Money movements and secure quick profits before the news release.

By analyzing the price action and volume, I identified a distribution phase, observed a No Demand signal, and spotted supply coming in—all of which indicated that Smart Money was preparing for a price reversal. This article breaks down my thought process, trade execution, and key lessons traders can apply when using Wyckoff and Volume Sprtead Analysis (VSA) principles in real-time market conditions.

Market Distribution and Smart Money Manipulation

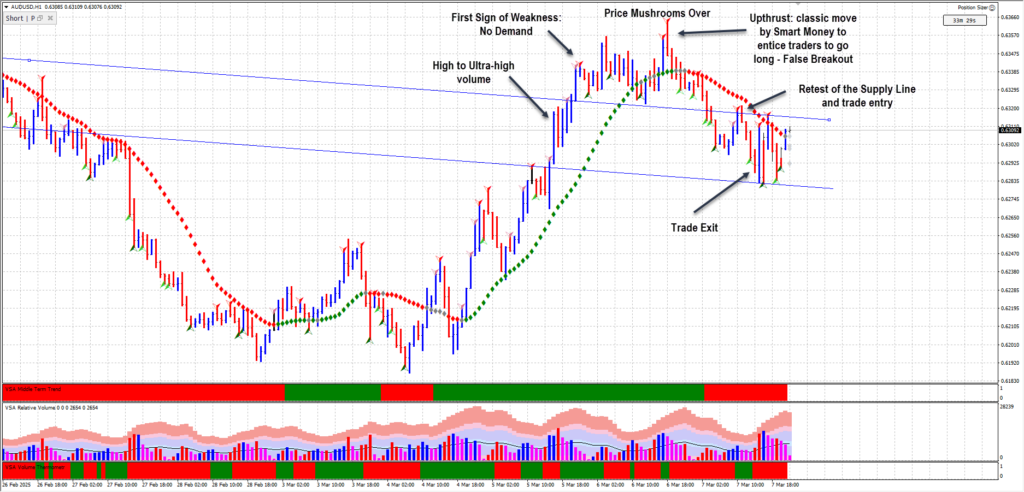

Before executing my trade, I analyzed the price chart and noticed signs of Smart Money distribution. The currency pair had been advancing steadily, but I observed a critical shift in volume dynamics:

- Several price bars exhibited high to ultra-high volume, indicating active professional participation.

- As price continued to rise, the volume declined, signaling a classic No Demand condition in VSA.

- Price eventually broke through a key resistance level, but the breakout occurred on low volume, confirming weakness.

In Wyckoff terms, this was a classic distribution phase, where institutional traders offload their positions to retail traders before marking the price down.

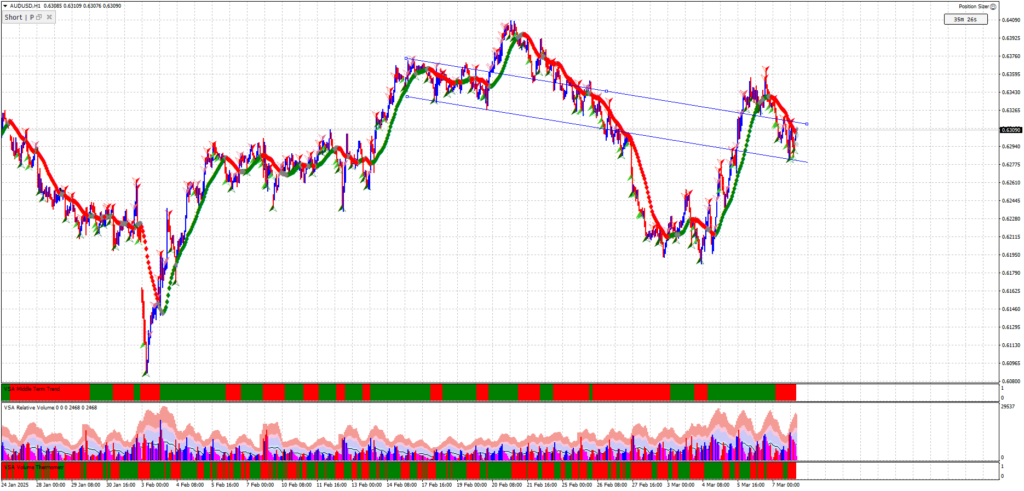

Additionally, I had been tracking a trend channel since February 17, 2025. Price had been respecting this channel, but the breakout above resistance on declining volume suggested that Smart Money was setting a trap—a maneuver designed to encourage uninformed traders to take long positions before a market reversal.

Trade Execution: Identifying the Entry Signal Using Wyckoff & VSA

As expected, price began to mushroom over after the false breakout, presenting a strong upthrust. In VSA, an upthrust is a move above resistance that quickly reverses, trapping buyers. This upthrust was my first sign that Smart Money was offloading positions.

Once price re-entered my trend channel, I waited for confirmation before entering my short trade. The key validation came during a retest of the supply line, where I observed:

- High volume on down bars, confirming that supply was present.

- Weak rallies on low volume, indicating that there was no genuine buying interest.

- A second failed attempt to push higher, proving that the market lacked demand.

At this point, I executed my trade:

- Entry Price: 0.63083

- Stop Loss: 0.63232

- Exit Price: 0.62910

This setup allowed for a high-probability short trade, aligned with both Wyckoff distribution principles and VSA supply signals.

Trade Management and Exit Strategy

After entering my short position, I carefully monitored price action. My confidence in the trade was reinforced by the following:

- No Demand Bars: Price attempted to rally but lacked volume support.

- Increased Supply: Heavy selling pressure appeared on down bars, confirming Smart Money was distributing.

- Lack of Follow-Through on Up Moves: The market showed repeated failures to push higher, proving that buyers were weak.

Given that the NFP announcement was approaching, I decided to exit my position after three hours to avoid potential volatility. While I could have potentially held for more profits, risk management dictated that I secure my gains rather than expose myself to unpredictable news-driven price swings.

Lessons Learned: Applying Wyckoff & VSA for Smarter Trading

This trade reinforced several critical principles that traders should keep in mind:

- Volume Tells the True Story: Price alone is misleading; volume confirms Smart Money’s intentions.

- No Demand Means No Future Uptrend: When price advances on weak volume, it signals exhaustion and an upcoming reversal.

- Upthrusts Are Smart Money’s Favorite Trap: Breakouts above resistance with weak volume often indicate a pending reversal.

- Retests Provide the Best Entries: Waiting for a retest of supply ensures confirmation before entering a trade.

- Exit Before Major News Events: While the setup was strong, I exited to avoid unnecessary volatility, a key risk management strategy.

By understanding Wyckoff and Volume Spread Analysis, traders can better identify Smart Money footprints and position themselves on the right side of the market.

Final Thoughts: Mastering Wyckoff & VSA for Consistent Profits

This trade exemplified the power of Wyckoff and Volume Spread Analysis in real-world trading. By tracking Smart Money movements, I was able to identify a distribution phase, recognize a No Demand signal, and enter at the right time.

For traders looking to enhance their edge, mastering Wyckoff and VSA principles is invaluable. Understanding how Smart Money manipulates liquidity allows you to trade with confidence and avoid being caught on the wrong side of the market.

By applying these concepts consistently, traders can make more informed decisions and improve their overall profitability.

FAQs

1. What is the Wyckoff methodology?

The Wyckoff methodology is a trading approach that analyzes market cycles, Smart Money activity, and price-volume relationships to predict price movements.

2. What is Volume Spread Analysis (VSA)?

VSA is a trading technique that examines the relationship between volume, price spread, and closing price to determine the presence of professional buying or selling.

3. How does an upthrust signal a reversal?

An upthrust occurs when price briefly breaks resistance on low volume and then quickly reverses, trapping buyers. This signals Smart Money distribution and a potential market decline.

4. Why is trading before NFP risky?

NFP releases cause extreme volatility, leading to erratic price swings. Smart Money often manipulates price before the announcement to trap traders.

5. How can traders avoid falling for Smart Money traps?

By studying volume, price action, and Wyckoff structures, traders can identify No Demand signals, upthrusts, and Smart Money distribution to avoid bad trades.

Further Reading:

Leave a Reply