Understanding when a bullish trend is about to end is crucial for traders and investors. In this article, I will show you exactly how to identify a USDCHF trend reversal on the 1-hour chart of USDCHF using Wyckoff principles and Volume Spread Analysis (VSA). Before diving into the chart, there are two fundamental concepts you must understand:

- Weakness appears on up bars with ultra-high volume.

- Strength appears on down bars with ultra-high volume.

Mastering these two principles will dramatically improve your ability to read the market and anticipate a USDCHF trend reversal.

Step 1: Identifying Weakness in a Bullish Trend

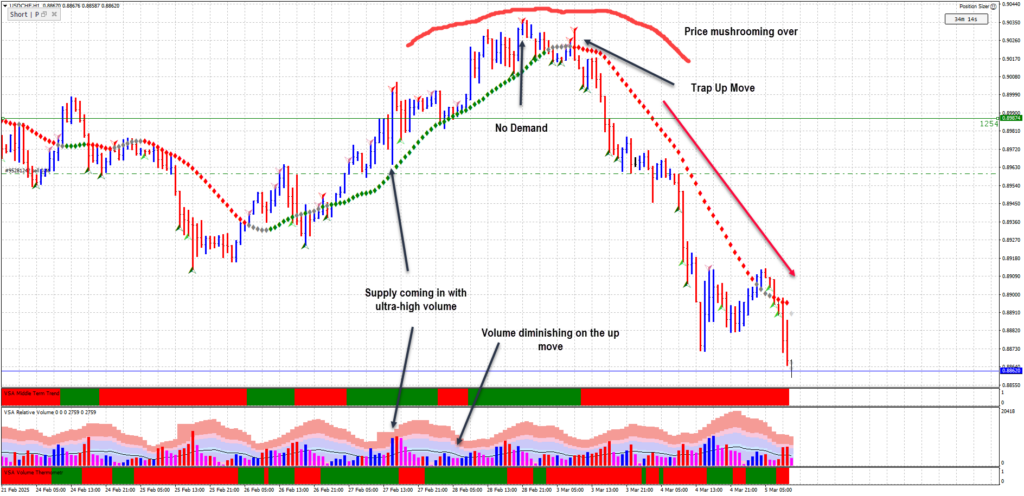

In the USD/CHF 1-hour chart, I have marked the first sign of weakness: a widespread up bar with ultra-high volume. This is a classic Wyckoff Supply Coming In signal. Professional traders are offloading their holdings, distributing them to retail traders who are still caught in the bullish sentiment.

While the price continues to rise, there are key signs that the USD/CHF trend reversal is nearing:

- Diminishing volume: Each successive push higher occurs on lower volume, indicating a lack of genuine demand.

- Mushrooming price action: The market structure starts forming a rounded top, which suggests distribution rather than accumulation.

Step 2: Recognizing No Demand and Trap Upmove in a USDCHF Trend Reversal

As the trend nears its peak, the following Wyckoff and VSA signals confirm that a USD/CHF trend reversal is preparing to take place:

- No Demand Bar: A narrow-range up bar on low volume, signaling that professional traders are no longer supporting the move.

- Trap Upmove: A final attempt to push prices higher, often forming a false breakout, before collapsing.

When these elements align, it’s a clear indication that the uptrend is over and a USDCHF trend reversal is about to begin.

Conclusion: Using Wyckoff and VSA to Stay Ahead of a USDCHF Trend Reversal

By combining Wyckoff principles with Volume Spread Analysis, traders can anticipate the end of bullish trends and avoid getting caught on the wrong side of the market. Recognizing supply coming in, diminishing volume, no demand bars, and trap upmoves allows traders to time their exits effectively and even position for a USDCHF trend reversal.

If you apply these principles correctly, you will develop a keen eye for market manipulation and professional campaigns, giving you a powerful edge in trading USD/CHF and other forex pairs.

FAQs

1. What is Volume Spread Analysis (VSA)?

VSA is a method of analyzing price movements based on volume and spread (bar range) to determine market strength or weakness and detect a USD/CHF trend reversal.

2. What does “Supply Coming In” mean?

It refers to professional traders selling into a rising market, indicated by widespread up bars with ultra-high volume, often signaling a USD/CHF trend reversal.

3. What is a “No Demand Bar”?

A no demand bar is a small up bar with low volume, indicating that professional traders are not participating in the move, which can precede a USD/CHF trend reversal.

4. What is a “Trap Upmove”?

A trap upmove is a final push higher, often triggering breakout traders, before the price collapses, confirming a USD/CHF trend reversal.

5. How can Wyckoff and VSA help traders?

By understanding how professional traders operate, Wyckoff and VSA help traders avoid traps, identify USD/CHF trend reversals, and make informed trading decisions.

Further Reading:

Australia Q4 GDP Growth: Economic Indicators Signal Stronger Performance

Leave a Reply