Signs of a US Economic Slowdown

The US economic slowdown is becoming more apparent as several key indicators point to weakening momentum. Consumer spending and confidence are on the decline, leading to reduced investment willingness and slower money supply velocity, which historically results in lower asset prices.

Key Warning Signs of the US Economic Slowdown:

- Consumer spending is dropping.

- Consumer confidence is declining.

- Government employment is shrinking.

- Home sales across the country are slowing.

- Stock market volatility is increasing.

With US government spending also expected to decrease, the broader economic landscape appears increasingly fragile.

Market Outlook: Has the Slowdown Been Priced In?

Predicting the US economic slowdown’s trajectory over the next three to six months remains challenging. However, current market conditions suggest that a true slowdown has not yet been fully reflected in asset prices.

In contrast to 2023—when a full recession was widely anticipated and priced in—the current situation differs significantly. The market had already been in a downtrend throughout 2022, whereas today, post-election optimism initially fueled expectations of economic growth policies. Even those critical of current policies are more concerned about inflation rather than a recession. This discrepancy presents a major risk.

Additionally, Wall Street analysts are closely watching market movements, as noted in Yahoo Finance. A recent decline in consumer confidence and spending, coupled with market sell-offs, has raised concerns that the economy could be slowing faster than the Federal Reserve is willing to react.

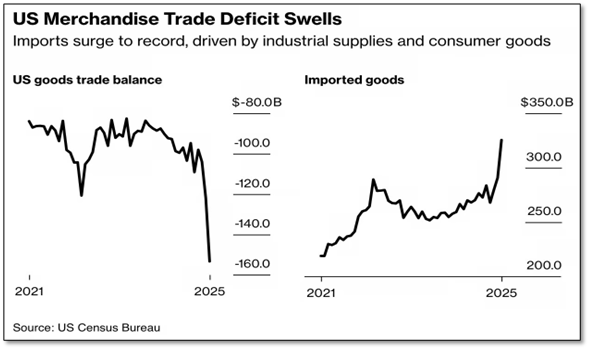

Tariffs and US Economic Growth: The Impact on Trade

Insights from industry professionals suggest that some US companies increased imports from Canada toward the end of last year in anticipation of tariffs. This likely boosted economic growth figures at the end of the year but may now contribute to weaker data going forward.

US GDP Forecast Cuts: What the Slowdown Means for Investors

The Federal Reserve Bank of Atlanta recently revised its US GDP growth forecast for the first quarter of 2025 from 2.3% to -1.5%. According to Yahoo Finance, this projection aligns with the US Bureau of Economic Analysis (BEA) maintaining its 2.3% annualized growth estimate for the fourth quarter of 2024. If this trend continues, it could signal further economic contraction in the coming months.

Experts such as Steve Sosnick, Chief Strategist at Interactive Brokers, caution that this environment may warrant reducing exposure to high-risk stocks. Defensive investments, such as low-volatility and dividend-paying stocks, could provide some insulation against market swings.

Conclusion: A Time for Caution Amid the US Economic Slowdown

Given the increasing signs of a slowdown, US investors should closely monitor economic data, particularly GDP trends and market reactions. While uncertainty remains high, preparing for potential volatility and adjusting risk exposure could be crucial strategies in the months ahead.

Further Reading:

Trump Announces U.S. Strategic Crypto Reserve: What It Means for Bitcoin, Solana, XRP, and More

Leave a Reply