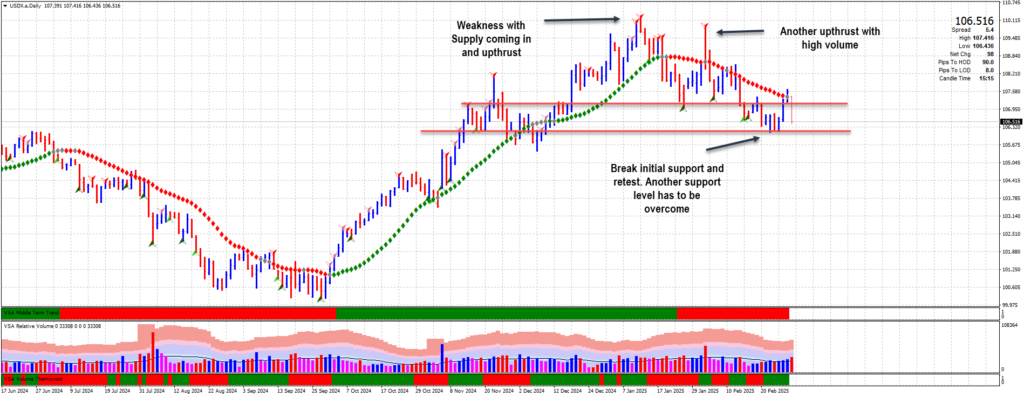

US Dollar Weakness: Key Wyckoff Principles in Play

Is US Dollar weakness starting to emerge? The US Dollar has been showing clear signs of weakness, with two critical Volume Spread Analysis (VSA) principles appearing on January 10th and January 14th—specifically, supply coming in and an upthrust. These events signal increased selling pressure and a lack of demand, both significant indicators of potential downward movement.

Why Are These Wyckoff Events Significant?

- Supply Coming In: This indicates large operators distributing their holdings as higher prices fail to attract sustained demand.

- Upthrust: Occurs when price tests the highs but quickly reverses with high volume, showing the presence of strong supply and a rejection of higher prices.

Automatic Rally and False Breakout

As the US Dollar dropped to around 1.07, the price reversed and tested previous highs with another upthrust. This confirmed resistance as sellers took control. The subsequent price action led to a sharp break of support, followed by a false breakout—another key Wyckoff principle.

Testing the Support Level Again

Currently, the price is retesting the support level. A break below this zone could signal further downside, but Wyckoff traders should watch for a potential retest of support before confirming a sustained downward move. If volume diminishes during the retest, it could indicate further selling pressure and a continuation of the bearish trend.

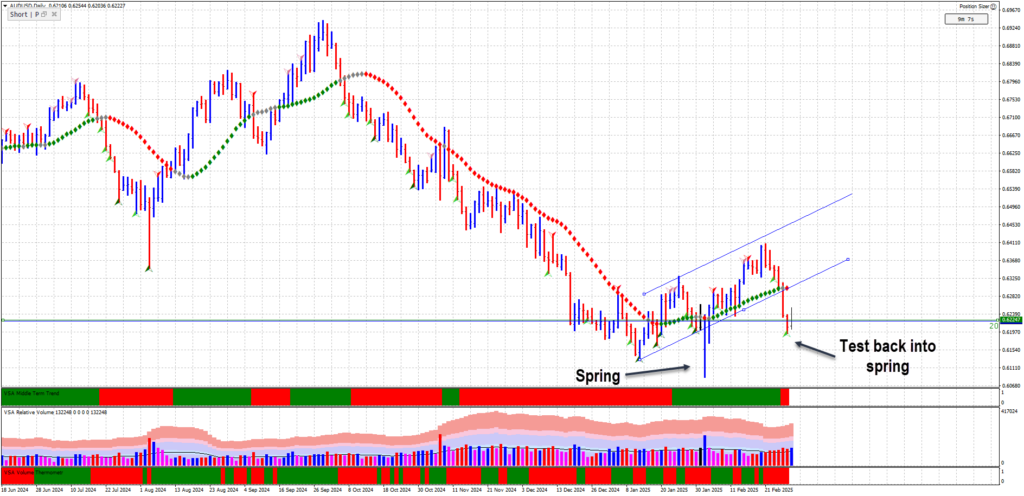

Australian Dollar Strength: Spring in an Uptrend

Unlike the US Dollar, the Australian Dollar is trading within an upward channel, showing signs of strength. Key Wyckoff events have appeared throughout this trend, reinforcing the bullish outlook.

Key Wyckoff Events on the Daily Chart

- February 3rd: Spring Formation – This occurred at a critical support level with high volume, indicating strong accumulation by smart money.

- Current Retest of the Spring Area – The price is once again testing this level, with strength beginning to appear, suggesting potential for a bullish move.

Potential AUD Rally in Context of USD Weakness

Given the weakness in the US Dollar, there is a strong possibility that the Australian Dollar will rally. However, before confirming a move higher, the AUD must first break through the lower trend channel line. If the price reaches this level and fails to break through, a retest of recent lows could occur.

Key Volume Analysis for Confirmation

- If volume diminishes on a pullback, it would indicate that supply is drying up, increasing the likelihood of a rally.

- Conversely, if volume spikes on a move downward, it could suggest further distribution, delaying the uptrend.

Conclusion: Key Levels to Watch

- US Dollar: A break of support followed by a low-volume retest could signal further downside.

- Australian Dollar: Needs to break through the lower trend channel to confirm strength; watch for diminishing volume on pullbacks.

Traders should monitor volume dynamics and price action at key levels to confirm potential moves in both currencies.

Further Reading:

Bitcoin Price Analysis: Impact of Trump’s Announcement on the Crypto Market

Leave a Reply