Introduction: A Classic Slingshot Trade Wrapped in a Rally

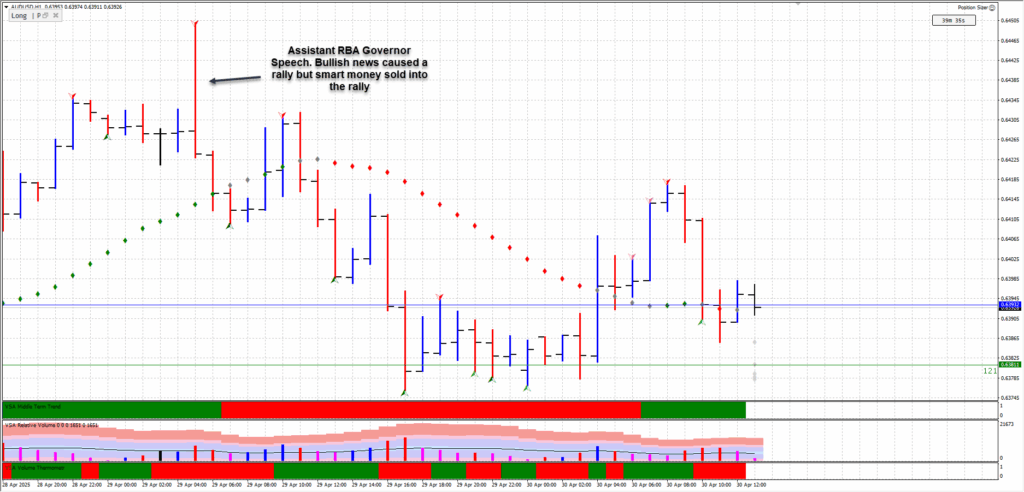

The Australian dollar (AUD) surged past key resistance levels on April 29, 2025. This followed bullish commentary from RBA Assistant Governor Christopher Kent. Retail traders piled into long positions, believing that macro fundamentals justified the move. The Smart Money saw it differently — they recognised the early signs of a slingshot trade rooted in Wyckoff principles.

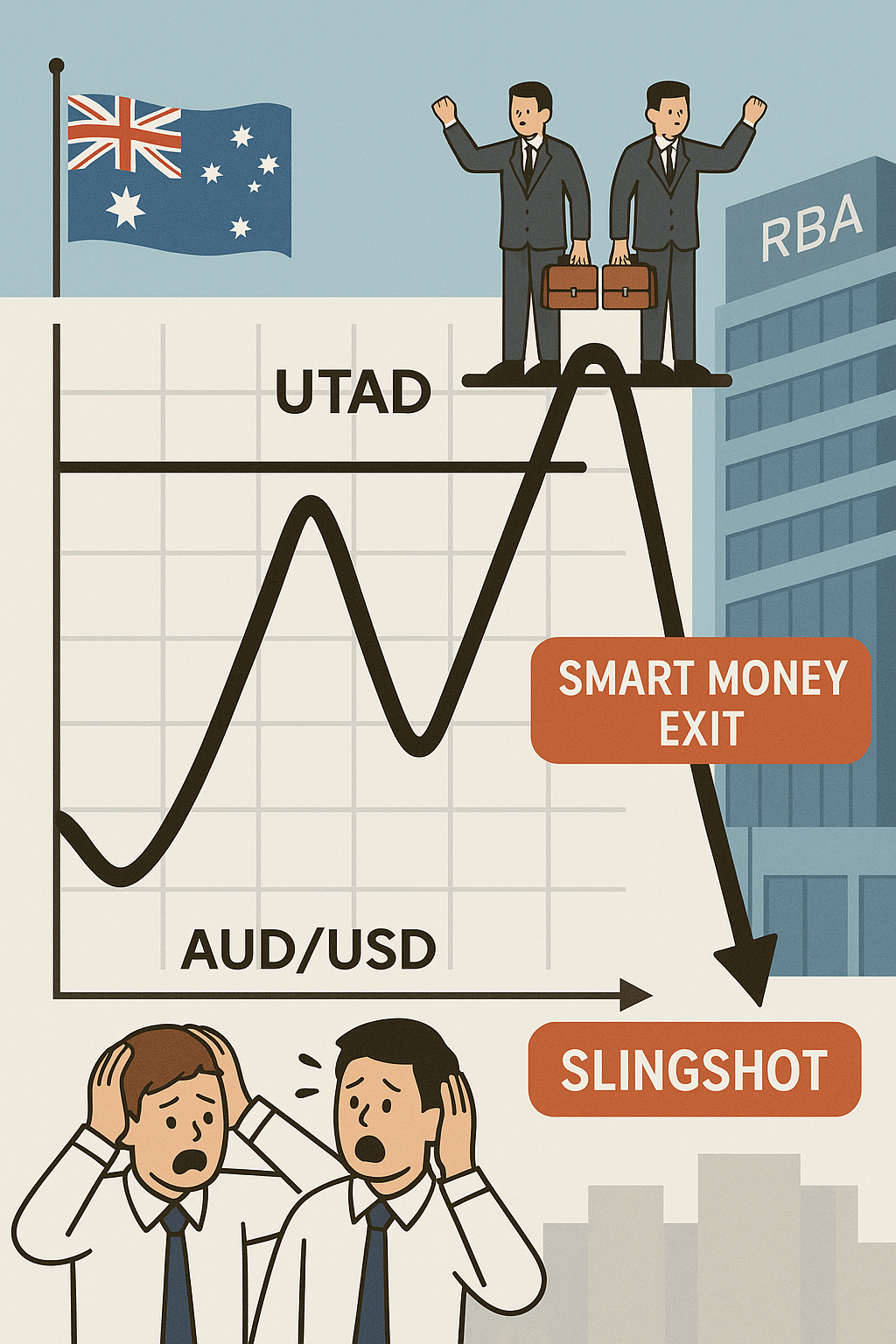

This wasn’t merely a breakout; it was a calculated slingshot trade. Smart money capitalised on retail excitement, using its strength to quietly distribute its holdings. Through the lens of the Wyckoff methodology, this was a textbook example of engineered liquidity. It was a bullish facade that concealed institutional selling pressure.

Phase A: Accumulation? Or the Foundation for a Slingshot Trade?

In the days leading into Kent’s speech, AUD/USD was in a tight consolidation range. It was positioned just below a significant resistance level. The market structure appeared to show signs of accumulation — a potential precursor to a breakout.

Deeper analysis revealed a different story:

- Volume decreased on down moves — not classic absorption.

- Volume spikes occurred only at resistance, a sign of distribution.

- There was no spring or shakeout to flush out weak hands.

This did not point to accumulation, but to redistribution, setting the stage for a slingshot trade. Smart money, or the composite operator, was biding its time. They were waiting for a macroeconomic catalyst. This would trigger retail buying at the highs.

Phase B: The Narrative Catalyst – Kent’s Comments Light the Fuse

During his address to the Australian Financial Markets Association, Assistant Governor Christopher Kent delivered remarks that lit a bullish fire under AUD:

“The accumulation of foreign assets has contributed to an extraordinary decline in Australia’s net foreign liabilities to levels last seen prior to 1983.”

“Superannuation funds now account for a substantial share of Australia’s capital outflows… their FX hedging activity has more than quadrupled since 2013.”

Kent’s remarks were interpreted by the market as a strong bullish signal. Retail traders saw a narrative of rising institutional AUD demand. Many interpreted the speech as a confirmation that the uptrend had fundamental support.

That was exactly what smart money needed. A news-driven catalyst would draw liquidity into the market. This set the trap for a slingshot trade.

Phase C: The Breakout – Upthrust After Distribution and the Slingshot Trigger

This is where the slingshot trade mechanism became visible.

AUD/USD surged above resistance with a strong bullish candle. Volume exploded. The volume wasn’t driven by smart money buying. It was retail chasing the news. The herd mentality played right into institutional hands.

The breakout was short-lived:

- Price pushed briefly above the range, forming an “Upthrust After Distribution” (UTAD).

- Smart money offloaded positions into buying pressure.

- Price reversed sharply within hours — a trap sprung.

This was the trigger point of the slingshot trade. It was engineered to trap breakout traders. It fueled the reversal with their stop-loss orders.

Phase D: The Slingshot Reversal – Whiplash for the Herd

After enticing long positions and absorbing retail volume, the reversal came fast.

AUD/USD plummeted back into the previous range, invalidating the breakout. This aggressive reversal — the core of the slingshot trade — triggered stop-losses, margin calls, and emotional exits. Retail traders, convinced they were riding a new trend, found themselves underwater in minutes.

This reversal wasn’t random. It was precision — a hallmark of smart money strategy using narrative + technical structure = liquidity harvest.

Phase E: Return to the Range – Reset and Reassessment

As of now, AUD/USD has retraced back into its original consolidation range. Momentum has dissipated. The bullish sentiment generated by Kent’s comments has faded. Traders caught in the move have either exited at a loss or are nervously holding through chop.

Meanwhile, smart money is back in control. They are reloading for the next campaign. This is likely setting the stage for a future accumulation phase or another slingshot trade.

Conclusion: Anatomy of a Slingshot Trade in Action

What happened on April 29 wasn’t a bullish breakout. It was a calculated, high-conviction slingshot trade orchestrated by smart money. Assistant Governor Kent’s speech provided the perfect backdrop. The Wyckoff structure provided the technical canvas. And retail emotion provided the liquidity.

This was a masterclass in how smart money traps are created — not with hype, but with planning and precision.

For Wyckoff traders and price action analysts, this was a reminder: Breakouts without cause are noise. Breakouts with narrative, timing, and structure? That’s where slingshots are born.

Leave a Reply