The stock market sell-off is causing widespread panic, with Wall Street experiencing a sharp and unexpected market correction. This downturn has led to significant declines across major indexes, raising concerns about the future of the economy. As uncertainty grips the financial world, traders are seeking opportunities in volatility while long-term investors question their next moves.

Wall Street’s Sudden Stock Market Sell-Off

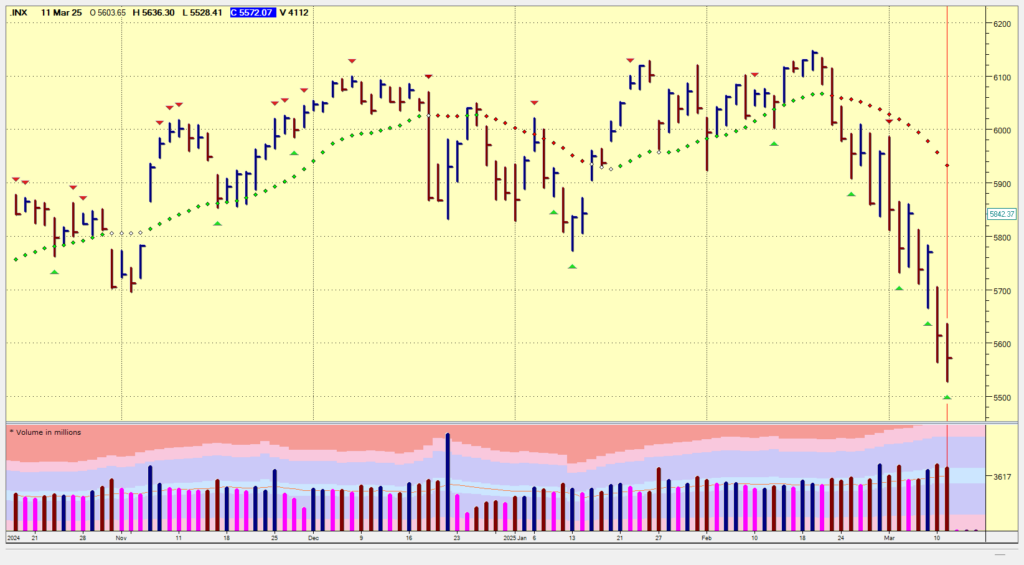

The stock market sell-off has hit major indexes hard. The S&P 500 has dropped over 10%, and the NASDAQ has also fallen sharply. Other indexes, like IWM (Russell 2000), have also seen big losses, plunging from 226 to below 199. This sell-off signals a shift in Wall Street’s view on economic stability and corporate earnings.

Economic Concerns Driving the Stock Market Sell-Off

One of the primary drivers of this stock market sell-off is the increasing uncertainty surrounding the global economy. The fear of a prolonged trade war and its potential impact on corporate earnings has created an atmosphere of panic. While economic data, such as strong job reports, suggests resilience, investors are worried about prolonged volatility and recession risks.

Tesla’s Struggles and Stock Drop During the Sell-Off

Tesla has been at the forefront of this stock market sell-off. Elon Musk’s involvement in political matters has raised concerns, but the real issue lies in declining sales. Tesla’s stock is experiencing a substantial correction, potentially reverting to price levels seen before November 2024. Investors are questioning Tesla’s ability to maintain its market dominance as competition intensifies.

Trading in Stock Market Sell-Off Volatility: A Double-Edged Sword

While the stock market sell-off presents challenges, it also creates unique trading opportunities. High volatility allows traders to capitalize on sharp price movements. However, this environment is dangerous for those without a solid risk management strategy.

For long-term investors, this period may be best spent avoiding impulsive decisions. Market corrections are normal, and historically, the stock market recovers over time. Investors are encouraged to stay patient and not react emotionally to short-term losses.

Market Psychology: Sentiment vs. Price Action in a Stock Market Sell-Off

Investor sentiment often follows price action rather than the other way around. When stocks are rising, the consensus is that the economy is thriving. Conversely, when stocks drop, fears of recession and financial instability intensify. This cyclical nature can cause overreactions in both directions, leading to extreme market fluctuations. Understanding this behavior is crucial for both traders and investors during a stock market sell-off.

Apple’s Role in the Stock Market Sell-Off

Apple has also played a significant role in the recent stock market sell-off. Despite holding strong in previous weeks, Apple’s stock has now corrected sharply, dragging down major indexes. With Apple being one of the largest components of the S&P 500 and NASDAQ, its movements have an outsized impact on the broader market. Traders are closely watching Apple’s price action for potential signs of market stabilization or further declines.

Long-Term Investment Strategy Amid a Stock Market Sell-Off

For those with a long-term perspective, a stock market sell-off provides an opportunity to average into high-quality investments. The S&P 500 remains a strong choice for diversified long-term growth. Historically, market downturns have always been followed by recoveries, reinforcing the importance of patience and disciplined investing.

Conclusion

While the current stock market sell-off is turbulent, understanding the factors behind the sell-off can help investors make informed decisions. Whether you’re a trader looking to capitalize on volatility or a long-term investor seeking stability, maintaining a clear strategy is essential. Despite the panic, history has shown that the stock market rewards patience and strategic investment. The key is to stay informed, remain disciplined, and navigate uncertainty with confidence.

Leave a Reply